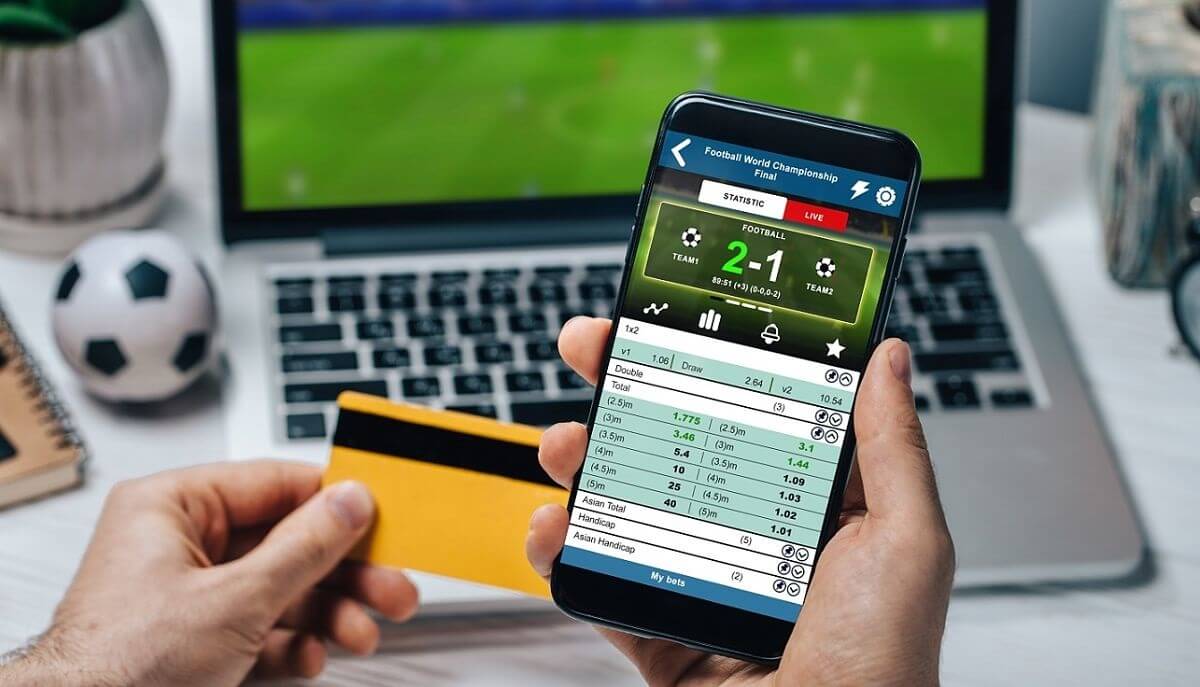

Benvenuti nel mondo delle scommesse online, dove l’emozione e l’opportunità si fondono in un mix entusiasmante. Se siete alla ricerca di siti scommesse inglesi non AAMS di alta qualità, siete nel posto giusto. Scoprirete i migliori operatori del 2024, pronti a offrirvi un’esperienza di gioco senza pari.

Perché Scegliere Siti Scommesse Inglesi Non AAMS?

Vantaggi Esclusivi

I siti scommesse inglesi non AAMS vantano una serie di vantaggi esclusivi. Dalla vasta gamma di eventi sportivi coperti alle quote competitive, questi operatori si distinguono per offrire un servizio su misura per gli amanti delle scommesse.